Key Takeaways

- Clarity and Direction: Setting specific financial goals provides a roadmap, helping individuals prioritize their spending and saving strategies to achieve financial stability.

- Measurement of Progress: Clearly defined objectives allow for the tracking of progress and necessary adjustments in financial plans, bridging the gap between aspirations and achievements.

- Focus on Priorities: Financial goals enhance focus by directing attention toward essential activities, ensuring daily financial choices align with long-term objectives.

- Motivation and Accountability: Establishing tangible targets boosts motivation and creates a sense of responsibility, allowing individuals to celebrate milestones and assess their financial journey regularly.

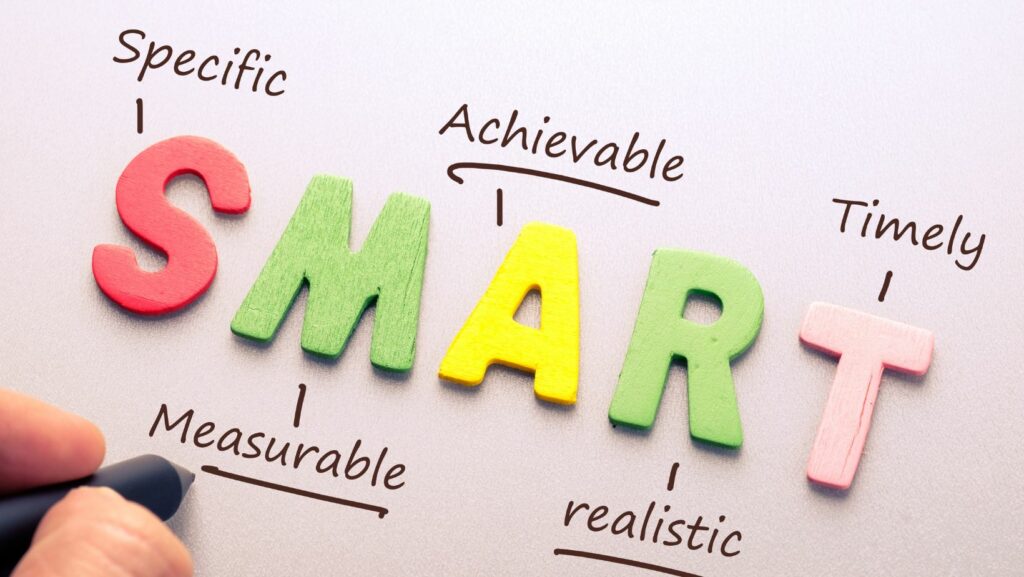

- Importance of SMART Goals: Utilizing the SMART framework—Specific, Measurable, Achievable, Relevant, Time-bound—improves goal-setting effectiveness, transforming vague ambitions into actionable plans.

- Review and Adaptation: Regular review and adjustment of financial goals ensure continued relevance and alignment with changing circumstances, promoting ongoing commitment to financial planning.

Setting clear financial goals is crucial for anyone looking to achieve financial stability and success. It provides direction and motivation, making it easier to navigate the often complex world of personal finance. Without specific goals, individuals may find themselves drifting, unsure of how to allocate their resources effectively.

Financial goals act as a roadmap, helping to prioritize spending and saving. They allow individuals to measure progress and make necessary adjustments along the way. By establishing well-defined objectives, people can transform abstract aspirations into achievable milestones, ultimately leading to a more secure financial future.

Overview of Financial Planning

Financial planning involves a systematic approach to managing personal finances, aiming to achieve specific objectives. It encompasses assessing the current financial situation, identifying goals, and formulating strategies to reach those goals. By evaluating income, expenses, and savings, individuals can gain insight into their financial health.

Specific goals play a crucial role in the financial planning process. They help prioritize decisions related to budgeting, investing, and saving. Goals transform abstract concepts into actionable plans, guiding individuals on their financial journeys.

Key components of effective financial planning include:

- Assessment of Current Finances: Evaluating income, expenses, current savings, and debts enable individuals to understand their financial standing.

- Goal Setting: Establishing short-term and long-term financial goals provides direction and clarity for future actions.

- Budgeting: Developing a budget based on defined goals ensures resources align with financial priorities.

- Investing: Identifying investment opportunities that align with financial goals enhances wealth accumulation.

- Monitoring Progress: Regularly reviewing financial plans allows individuals to track their progress and make necessary adjustments.

Financial planning enhances decision-making, promotes financial discipline, and lays the groundwork for a secure financial future. Clear financial goals enable individuals to make informed choices, facilitating the successful execution of their financial plans.

Why is Goal Setting Important in The Financial Planning Process?

Goal setting plays a critical role in financial planning by providing clear markers for success. Specific financial objectives guide decisions and facilitate effective resource allocation.

Enhances Focus and Direction

Goals direct attention toward essential financial activities. By establishing clear milestones, individuals can avoid distractions and prioritize their efforts. For example, saving for a home down payment or planning for retirement enables focused actions, such as directing funds into savings accounts or investment vehicles. This focused approach improves decision-making and ensures that daily financial choices align with long-term aspirations.

Boosts Motivation and Accountability

Setting financial goals increases motivation by creating tangible targets to strive for. When individuals define specific amounts or timeframes, they can celebrate achievements along the way, such as reaching savings benchmarks or completing debt repayments. Additionally, clearly defined goals enhance accountability. Individuals can track their progress and evaluate results against set timelines, fostering a sense of responsibility toward their financial planning efforts. Regularly assessing progress reinforces commitment and encourages continuous improvement towards financial aspirations.

Types of Financial Goals

Financial goals can be categorized into short-term and long-term objectives. Each type plays a crucial role in the financial planning process, helping individuals prioritize and allocate resources effectively.

Short-Term Goals

Short-term financial goals typically span a period of one year or less. They often focus on immediate needs and objectives that facilitate financial stability. Examples include:

- Emergency Fund: Building a fund to cover unexpected expenses, such as medical bills or car repairs.

- Debt Reduction: Paying off high-interest debts, such as credit card balances, to improve cash flow.

- Savings for a Vacation: Setting aside funds for a planned trip, promoting responsible spending and saving habits.

- Budgeting for Holidays: Planning for holiday expenses to prevent overspending and financial stress.

Short-term goals provide immediate motivation and reinforce good financial habits, contributing to overall long-term success.

Long-Term Goals

Long-term financial goals extend beyond one year, addressing broader aspirations that typically require substantial planning and commitment. Examples include:

- Home Ownership: Saving for a down payment to purchase a home, ensuring financial security and investment growth.

- Retirement Savings: Accumulating funds in retirement accounts to ensure a comfortable lifestyle after exiting the workforce.

- Education Savings: Contributing to college funds for children or oneself, preparing for the rising costs of education.

- Investment Growth: Developing a diversified portfolio to build wealth over time, improving overall financial health.

Long-term goals shape an individual’s financial landscape, encouraging sustainable habits and providing a framework for decision-making throughout life.

Strategies for Effective Goal Setting

Effective goal setting in financial planning involves structured approaches that enhance clarity and focus. Implementing specific strategies ensures individuals remain aligned with their financial objectives.

SMART Goals Framework

Creating goals using the SMART framework enhances effectiveness. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound.

- Specific: Clearly define the goal. For instance, instead of saying “”save money,”” specify “”save $5,000 for a vacation.””

- Measurable: Include metrics to track progress. This might involve setting monthly savings targets, such as saving $500 per month.

- Achievable: Set realistic goals. Assess current financial capabilities to determine if the goal is attainable within the specified timeframe.

- Relevant: Ensure the goal aligns with broader financial objectives. For example, saving for a car should fit within a larger financial strategy.

- Time-bound: Attach a deadline. Goals should have a specific completion date, creating urgency and accountability.

Utilizing the SMART criteria aids in transforming vague objectives into actionable plans, making it easier to stay focused and motivated.

Regular Review and Adjustment

Regularly reviewing and adjusting financial goals maintains relevance and encourages progress.

- Monitor Progress: Conduct monthly reviews to assess achievements against set milestones. This practice can highlight areas needing improvement.

- Adjust Goals: Modify goals as financial situations change. For instance, an unexpected expense may require shifting priorities or extending deadlines.

- Reevaluate Motivations: Identify any shifts in interests or circumstances that impact goal relevance, ensuring they remain aligned with personal values and life changes.

- Celebrate Milestones: Recognize achievements to boost motivation. Celebrating small victories reinforces commitment and encourages continued progress toward larger goals.

Adopting these strategies enhances financial planning effectiveness, fosters a proactive approach, and ensures ongoing alignment with personal aspirations.

Cornerstone of Effective Financial Planning

Goal setting is a cornerstone of effective financial planning. It empowers individuals to create a clear path toward financial stability and success. By establishing specific objectives, they can prioritize their financial activities and make informed decisions that align with their long-term aspirations.

Regularly reviewing and adjusting these goals keeps individuals engaged and motivated in their financial journey. This proactive approach not only fosters accountability but also enhances the ability to adapt to changing circumstances. Ultimately, well-defined financial goals transform aspirations into achievable milestones, paving the way for a more secure and prosperous future.